Are you relocating to Vancouver, BC and need to know about the cost of life? That was exactly my situation a month ago!

Salary expectations are way easier to be figured out when you know the amount of the basic expenses.Finally I didn’t made the move, but hey, here’s my personal notes about living in town.

Basically a cut n paste from the web plus information of friends of friends.

SALARIES

Student: c$ 1,200—1,500

“c$ 1.800—$2k buys a modest living for a healthy single (no car, possible flat-share vs. longer commutes)”

Single professional: c$ 2k—3k

“to have c$3k /m net means above c$ 5ok /y. A small amount of Vancouverites makes that.”

Family with 2 children: c$ 5k—7k (c$ 60k—84k)

The average household income in Vancouver (2013) is c$ 81,066.

wages:

c$ 22.98 /h average wage (according to the Ministry of Labour)

c$ 10.45 /h minimum wage (British Columbia, 15 Sept 2015)

TAXES

(1) Income Tax (federal):

15% on the first c$ 45,282 of taxable income

+ 20.5% on the next c$ 45,281 of taxable income (c$ 45,282 up to c$ 90,563),

+ 26% on the next c$ 49,825 of taxable income (c$ 90,563 up to c$ 140,388),

+ 29% on the next $ 59,612 of taxable income (c$ 140,388 up to c$ 200k),

+ 33% of taxable income over c$ 200 k.

The “+” means that no matter how much money you earn, you only pay 15% tax on your first $45,281 of income.

(2) Provincial Sales Tax (PST) – 7%

(3) Goods and Services Tax (GST, federal) – 5%

Here’s a simple and a complex online tax calculator.

HEALTHCARE

A single person pays about c$ 65 a month for full medical coverage (c$ 130 a month for a family, FYI). BC Medical does not cover dental, optical or prescriptions. Provincial health coverage is mandatory, but expats have to wait 3 months before they can benefit from it.

Expats should ensure that they have comprehensive health cover in order to have access to private healthcare facilities.

ACCOMMODATION

“Many people are investing their in real estate and commercial property just to make good returns. They have their primary residence elsewhere, but buy properties in Vancouver.”

“Many Vancouverites pay over 50% of their wages towards their rent”. Most accommodation is listed as unfurnished. Even so, it often includes appliances (such as a refrigerator and stove), with newer rentals possibly even including a washer, dryer, microwave and dishwasher.

A large comfy room in a flat-share would costs c$ 700 or more.

For a 1-bedroom apartment in a good part of the city with fairly modern renovation, building etc. expect to pay c$ 1,000 /m at least. Average rent in the city center is c$ 1,550 (1,250—1,800); outside of centre is c$ 1,150 (900—1,400).

An average 2-bedrooms apt. 10-15 min drive to downtown costs ca. c$ 1,200—1,600 +utilities. A nice, well-located one would cost c$ 2,000 /m (“in the heart of Vancouver it costs double before long”). detached home within Vancouver City limits costs c$ 2,800—4k.

Outside the core, rents might not be significantly cheaper unless you go outside Vancouver or decide to rent a basement suite in a residential neighbourhood.

Rental periods tend to be for a year, although six-month leases are sometimes negotiable.

Security deposits of either one or two months’ rent are required and unfurnished apartments usually come with basic appliances such as a stove and oven.

Utilities are generally excluded but it might be possible to negotiate these costs into the rental price.

Hydro (which means electricity): c$ 50—200 per month, depends on whether you heat your home with electricity or gas or if heat is included in the apartment rental. Often apartments will include heat and hot water in the rent. In that case, your hydro bill will be around c$ 25—90 a month.

If you use gas for ducted heat or cooking you’ll pay anywhere from c$ 30—100 a month. Might be included in rent.

Landlord might require to have a Tenant Insurance (around c$ 25 /m).

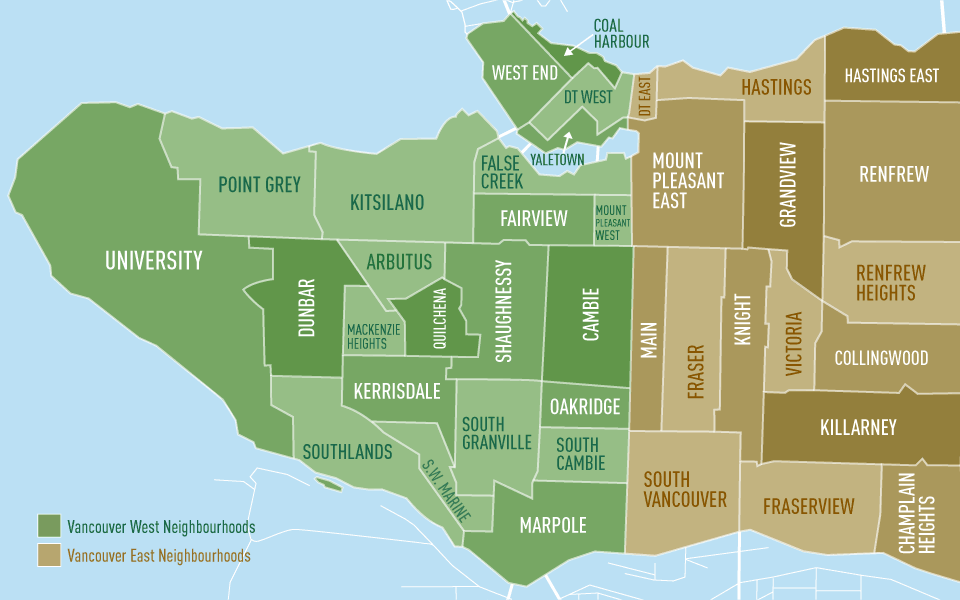

AREAS

The city of Vancouver is divided into four general areas: Central, West Side, Eastside and South Vancouver. “There are many neighbourhoods in Vancouver to discover and explore. Expats should not rush the process but spend time doing some research and finding the right community to suit their needs, family situation and lifestyle.”

EXPENSES

“Prices for everything are high and people love to complain about it.”

Wind and Mobilicity are new players in the cell phone industry in Canada and their service area is not as large as the big 3 (Telus, Rogers, Bell). Other carriers: Fido (another Rogers’ brand), Solo (another Bell brand), Koodo (another Telus brand). Mobile tariff is approx. c$ 50, c$ 80 a month for landline Internet.

LIFESTYLE

“The lifestyle in Vancouver is what really gets you – expect to do lots of casual drinking, because everyone who lives there seems to be invested in a strange faux urbane lifestyle that consists mostly of drinking a lot of beer every night of the week and ignoring all the people around you while sticking obsessively to your group of friends (if you can make any).

If you want to engage in any kind of outdoor hobby be prepared to shell out for the transit (most of the hiking, mountain biking, skiing is in North Vancouver) and the lift ticket/admission. I didn’t have a bad financial life in Vancouver, but for the record I’ve been much happier and much less messed up by pretentious people and borderline alcoholism since I left.”

Snap! I read a lot of critiques about the town! They can be summarised in this comment I read somewhere:

“Other than the mountain and ocean view there’s nothing special about the city”.

A couple of websites states that the nightlife is decidedly low-key,

“…party-goers might find a little dull”.

Several replies by locals defend the town, including a bunch of “if you don’t like the place move over!”, which in my experience confirms the rumors of the place.

“All in all though, most expats report that living in Vancouver is a treat.”.

Who’s right?

WEATHER

It rains a lot.

Summer and part of Fall is lovely. It can be hot but not muggy.

Nov—March is dark and gray

Winter is milder than the rest of Canada, but it gets depressing with month after month of rain and dark clouds with temp of 0 to -5C.

Daytime temperatures usually stay above freezing (5—11 C). It rarely snows in the city.

SO WHAT?

$ 1,300 accommodation

$ 150 utilities

$ 25 Tenant Insurance

$ 65 healthcare

$ 250 groceries ( up to $800 for a family of 4, FYI)

$ 91 transportation

$ 10 bank account (Canadian banks charge a monthly fee)

$ 50 cellphone

$ 250 fun +hidden expenses

------

$ 2,191

This would be the minimum amount for survival. In other words, earning this amount net would most likely leave no money left on your account at the end of the month.

So on top of this amount it should be added things like savings expectations and and personal consideration on the job, in terms of professional requirements, responsibilities and so forth.

QUOTE OF THE DAY (South Park, the Movie): “the Canadian Government has apologized for Bryan Adams on several occasions” — Canadian Film Minister